"With the economic turmoil we’ve seen lately, we’re focused on the real-world implications of that." Q&A with Insider's Deputy Executive Editor, Business, Joe Ciolli

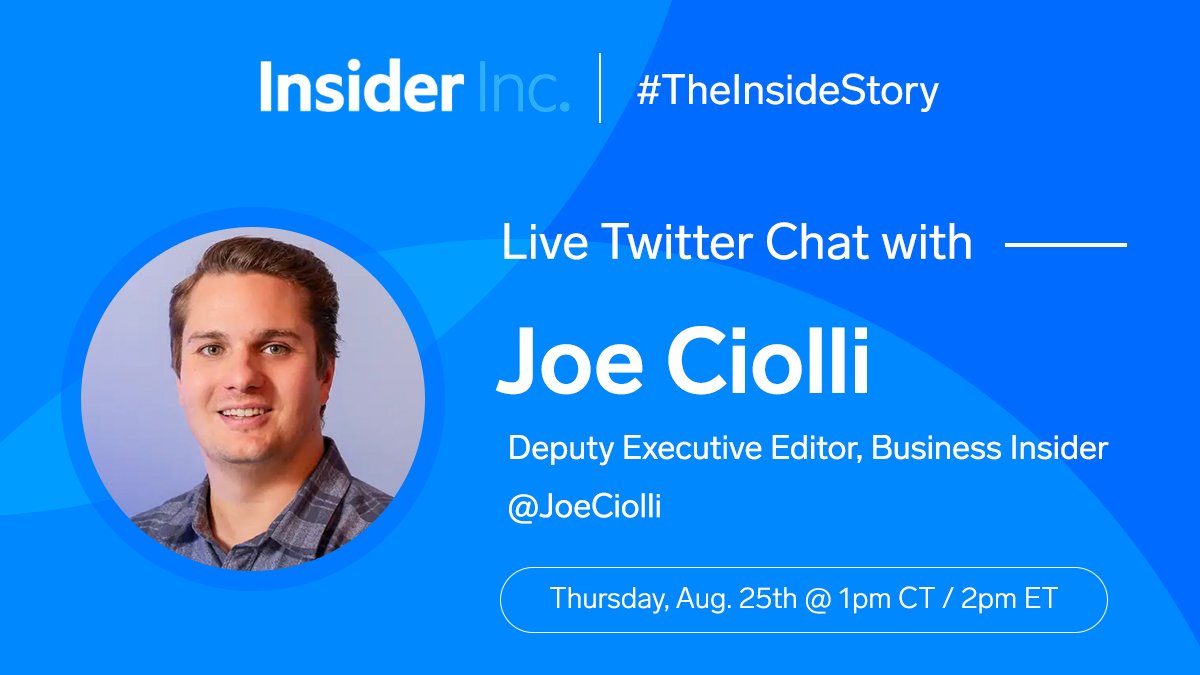

To help our readers get to know the people that power our newsroom, we host live Twitter conversations called #TheInsideStory on our @InsiderInc account with reporters and editors from our Business, Life, and News sections.

We recently caught up with Joe Ciolli, Deputy Executive Editor, Business, who covers the state of the economy, current market trends, investing, During our conversation, Joe spoke about his role, provided insight into all angles of the economy, and how he and his team stay up to date with the latest information to break it down for readers. Be sure to follow Joe on Twitter @JoeCiolli and check out his page on Insider.

Thanks so much for joining us today @JoeCiolli. To kick things off, could you tell us more about your role at Insider?

Hello! I’m a deputy executive editor at Insider, in the Business division, and I oversee 3 teams. Investing (paywalled), Markets Insider (non-paywalled), and Economy (non-paywalled). That accounts for 9 editors and roughly 30 reporters.

Hello to you! Thanks for sharing. In addition to leading your teams, you’ve also had extensive experience reporting on stocks and finance. Can you tell us more about your background and any “stand-out” moments?

I’ve been in journalism since 2011, after switching away from i-banking. Before Insider I was at Bloomberg for 7 years covering markets. Standout moments: interviews / widely read stories with legends Jeremy Grantham and Rick Rieder a byline on a Businessweek cover piece.

How cool is that? Focusing on Insider, can you tell us what a "normal" day looks like for you as Deputy Executive Editor?

No day is the same, but the average one includes some combination of: reading the research in my inbox, brainstorming/assigning stories on the big topics of the day, meeting with reporters and fellow editors, recruiting new hires and, of course, editing.

We certainly relate to the fact that no day is the same, and that's further supported by that there's no shortage of headlines in the business, markets, and finance spheres recently. What areas are you and your team most focused on?

With the economic turmoil we’ve seen lately, we’re focused on the real-world implications of that. We aim to not only inform people of what’s going on, but also make sense of it for them. The stakes are way higher than they were last year, when meme stocks and crypto dominated.

You and your team also accomplish this by covering the economy from ALL sides - from the recession debate to stock market performance and everything in between. How do you choose which angles to focus on?

It’s all about answering the questions our readers have — and those questions change all the time. This year the focus on Markets has been what to do and how to invest as the Fed raises interest rates. And on Economy it’s been all about inflation and the recession outlook.

Because questions and priorities change frequently, this adds a layer of complexity to already-complicated topics and industries. Where do you and your team find the latest information about business, markets, and the economy?

It’s a combination of following the news, reading research, analyzing social-media trends, and interviewing experts. By doing all of that we have a really strong idea for what people are most interested in, and what crucial events are upcoming.

As you do research and stay up to date, are there any personal favorite subjects that you enjoy learning more about and cover? Can you share examples?

I like stories about what makes people tick. If an investor is great, I want to know why. What are their secrets for outperforming millions of people doing the same thing? On the Economy front, if someone is being hurt by inflation, how can we humanize that?

We completely agree. Digging into the "how" and "why" is crucial! And, speaking of investing, is there any advice you would give to those curious about investing now?

I tell my wild crypto-trading friends this all the time: only invest in something if you can explain why you’re doing it. Don’t chase trends or blindly follow what someone told you to do. If you don’t want to do the research, stick to diversified assets like ETFs and index funds.

That's a solid piece of advice that can really be applied to many different scenarios, too! Thanks for that. Referring to trading and stocks in general, what's the latest our readers should know in this space?

The only game in town for stocks right now is what the Fed will do with interest rates. All of our other big topics — most notably inflation and the prospect of recession — are either inputs or outputs of that. Meme stocks are fun, but don’t speak for the whole market.

We’re winding down to the end of our Q&A, but before you go, what’s your favorite part about working at Insider?

It has to be the freedom to experiment with different things in the name of keeping our audience interested. We don’t have to stick to a set daily routine, or write about something if it’s not resonating. I like how hyper-focused we are on keeping our readers entertained.